Evergrande Debt Ratio

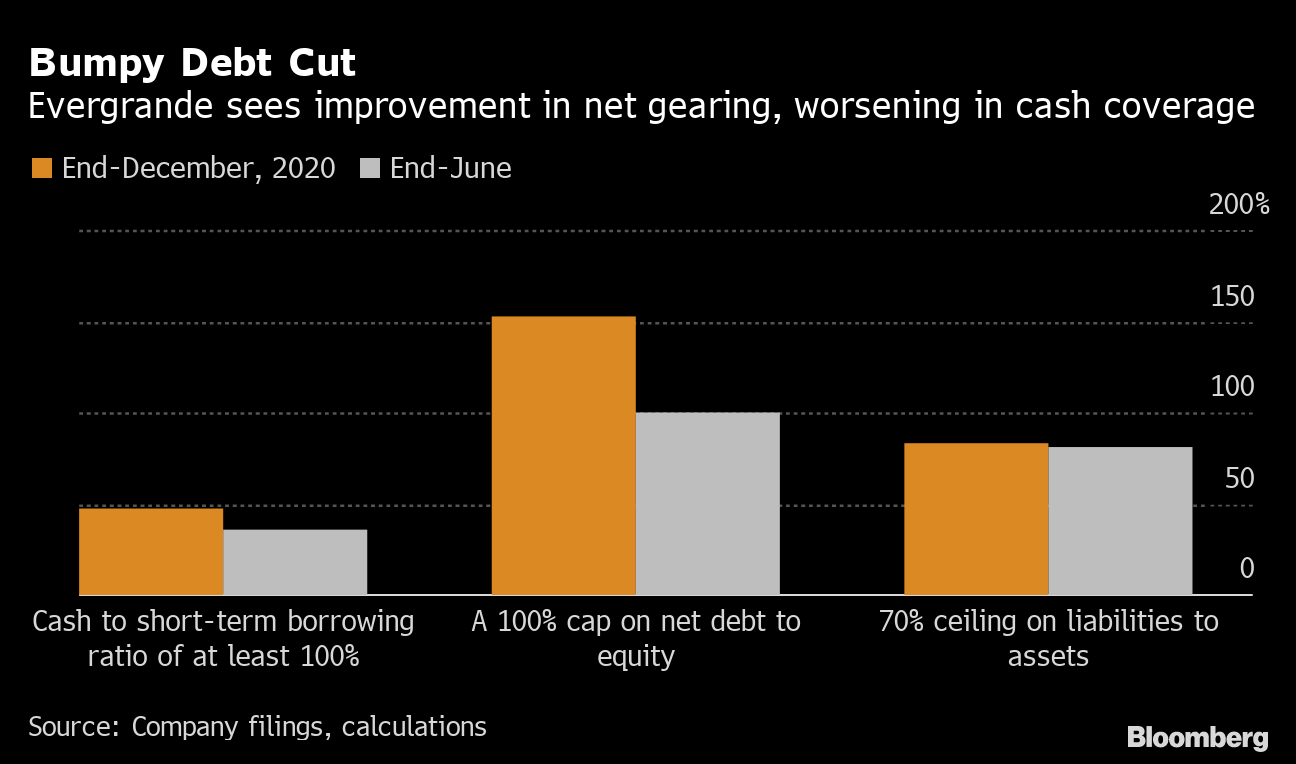

Evergrande vows to cut its debt for the first time aiming to slash net gearing ratio to 70 by June 2020 from 240 in June 2017. China Evergrande Groups debt to equity for the quarter that ended in Dec.

Evergrande vows to cut its debt for the first time aiming to slash net gearing ratio to 70 by June 2020 from 240 in June 2017.

Evergrande debt ratio. 2020 was 490. A high debt to equity ratio generally means that a company has. Evergrande debt ratio.

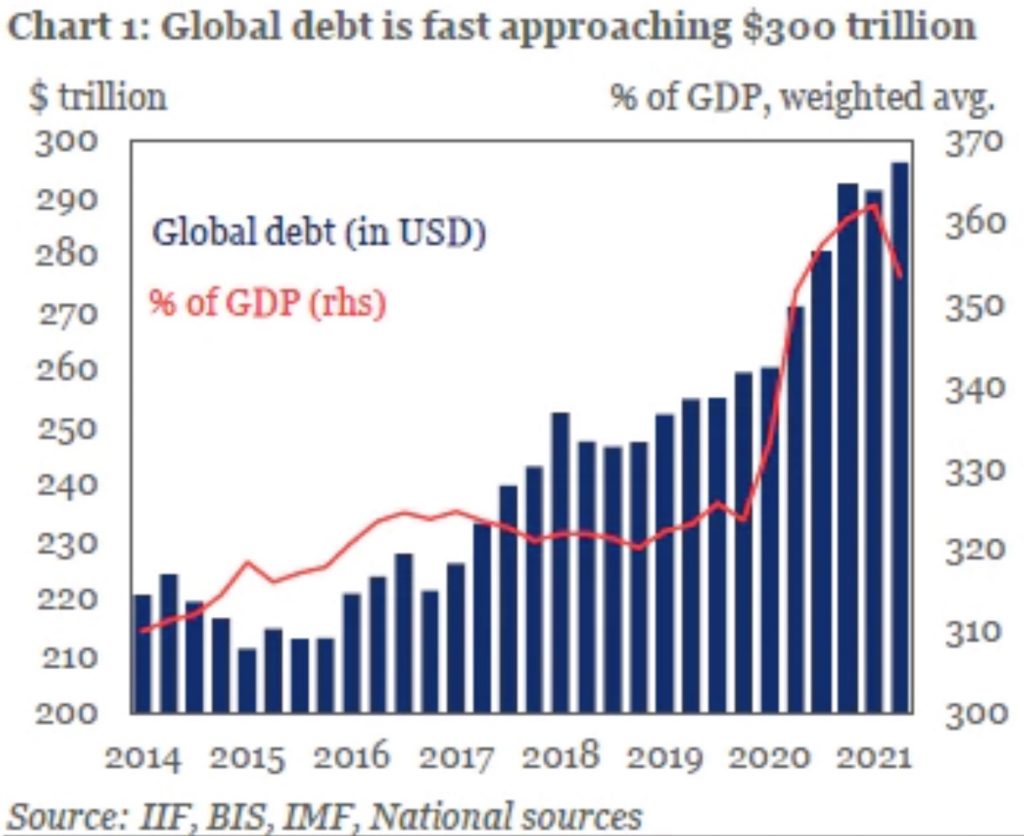

Debt to Equity Ratio Definition. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity. The central bank names Evergrande in a report as one of the few financial holding conglomerates on its watch that it says.

China S Scrutiny Of Shadow Debt Bites Developers Like Evergrande Bloomberg

China Evergrande Profit Drops As Developer Seeks To Ease Cash Crunch Bloomberg

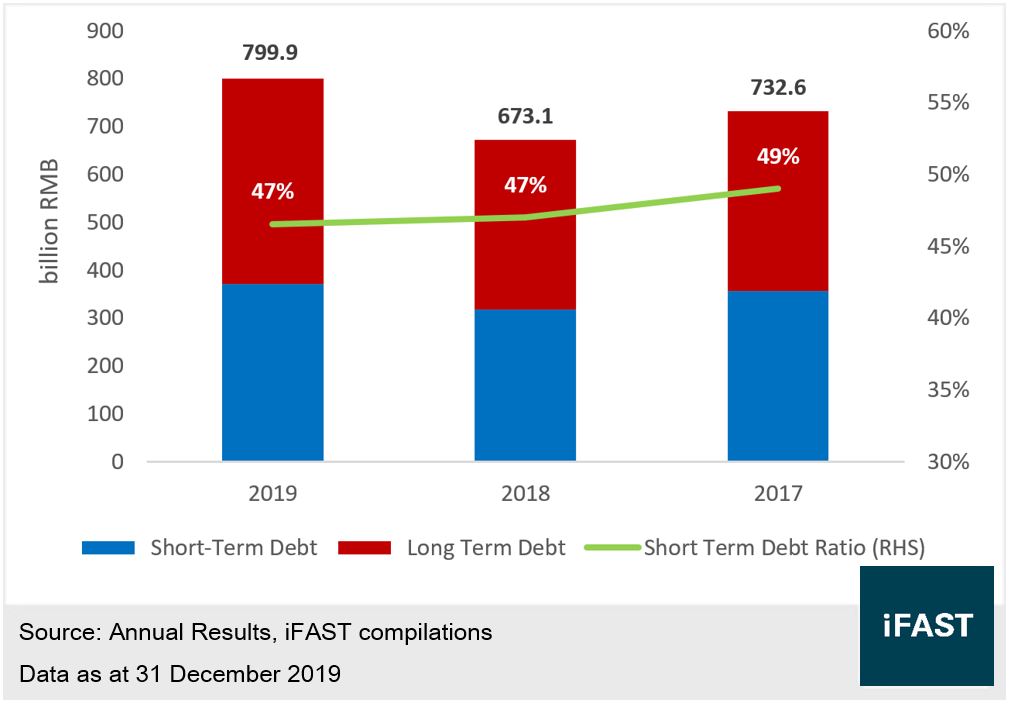

Evergrande Entering The Era Of Deleveraging Bondsupermart

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

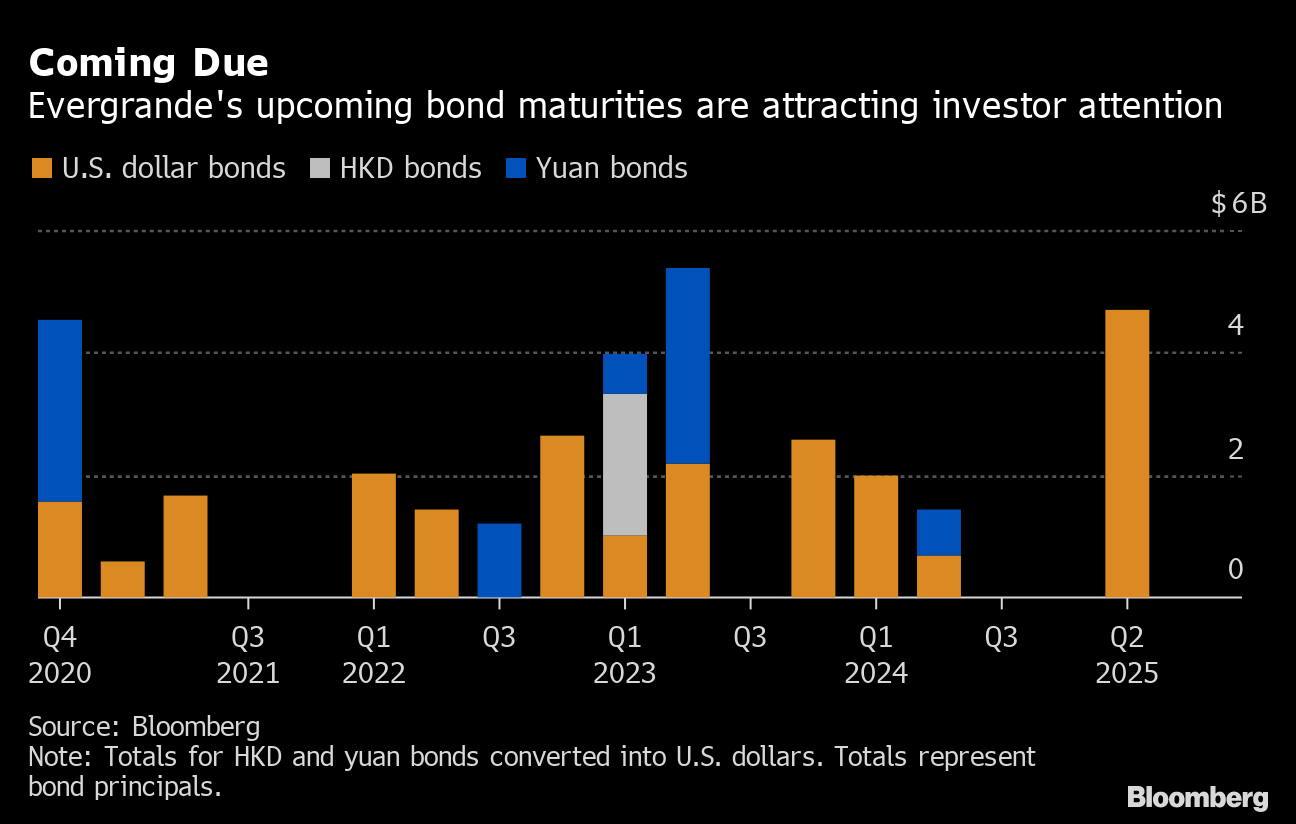

Evergrande Squeezed By 53 Billion Of Maturities In Tough Market

0 Response to "Evergrande Debt Ratio"

Post a Comment